WARNING: This article is largely off topic. If you don't want to learn about FamilySearch employee investment options, stop reading now.

In the news we hear of investment companies going under because of bad mortgage loans. Democrats blame republicans for decreasing regulatory oversight. Republicans blame company CEOs and are taking steps to prevent CEOs from escaping with golden parachutes. The Dilbert cartoon strip for 10 June 2008 is eerily prophetic of the current news. The individual shown at the podium is the company CEO.

FamilySearch 401 K Preset Options

My mom always taught me, never invest any money in stocks that you can't afford to lose. Mutual funds mitigate some of the risk, but not all of it. Risk is lowered by diversifying. No asset class does well in every economic environment. And in bad economic times, not all asset classes do as poorly as the worst performers. Risk is also lowered by staying in the market long term. Downturns have always been temporary, and if you can wait them out, the stock market as a whole does well over longer time frames. Bond funds don't spike as high or as low as stock funds. In general, the greater the possibility for gain in a particular asset class, the greater the possibility for loss. The risk for large gains or large losses of large-cap, mid-cap and small-cap stocks are medium, higher and highest, respectively.

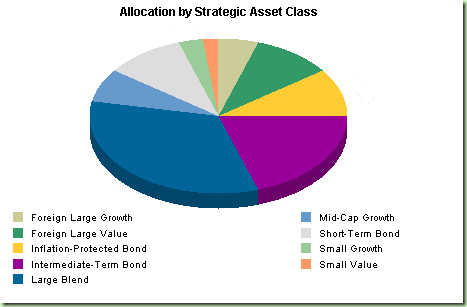

FamilySearch employees are offered a 401K plan with several different preset mixes. I've eliminated the percentages from the FamilySearch preset mixes, since they might be considered propriety information. But I'd like you to see the general breakdowns shown by the pie charts below.

WARNING: The information contained herein is for educational and comparison purposes only and may not apply to your individual financial situation. You should consult with your own financial advisor before making financial decisions.

If you're within 5 years of retirement, the FamilySearch short term preset mix looks like this. The investments have lower yields, but also less risk.

If you're within about 10 years of retirement, you can be less conservative.

If you're over 10 years away from retirement, you can place even more at risk.

Employer matches for your contributions to a 401 K plan are one of the best risk mitigations. For example, if your employer matches 100% of your contribution up to $1,000 and you invest $1,000, then you've already doubled your money. The market could drop a whopping 50%--lose half its value--and you would still break even. It almost always makes sense to save up to the point where your employer stops kicking in free money.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.